property tax assistance program florida

This also includes widows and widowers who can get an exemption of up to 500. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners.

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Property Tax Assistance Programs If your appeal doesnt work or isnt an option there are still a few different ways to get help when your property taxes come due.

. Its designed to help low-income homeowners by ensuring that the property tax is based on the percentage of an individuals income rather than the propertys value. In addition to that many states and local. The final deadline for property taxes payment is December 14 2020.

SUITE 3 TALLAHASSEE FL. Book A Consultation Today. In Florida local governments are responsible for administering property tax.

Principal address is 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312. The homestead exemption and Save Our Homes assessment. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

We Offer A Free IRS Transcript Report Analysis 499 Value. Check Your Eligibility Today. Was incorporated on Jul 06 2018 as a FLLC type registered at 1400 VILLAGE SQUARE BLVD.

Information is available from the property. Florida - A homestead exemption of up to 50000 is in effect for a primary home. Book A Consultation Today.

Additionally many states including Florida offer some homeowners property tax relief. In many states tax agencies impose property taxes on personal property. Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney.

Is an Inactive company incorporated on July 6 2018 with the registered number L18000163659. Certain property tax benefits are available to persons 65 or older in Florida. Rated Number One For Businesses.

Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. We would like to show you a description here but the site wont allow us. There are two types of.

Ad Suffering From Tax Problems. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Eligibility for property tax exemptions depends on certain requirements.

Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. We Offer A Free IRS Transcript Report Analysis 499 Value.

Ad Suffering From Tax Problems. Households can challenge their local government town or city hall on their total property tax bill and this is done by contesting the assessment. Was filed on 06 Jul 2018 as Limited Liability Company type registered at 1400 VILLAGE SQUARE BLVD.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Consult With ECG Tax Pros. Check Your Eligibility Today.

Meanwhile you can send your. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and. The Homeowner Assistance Fund HAF is designed to mitigate financial hardships associated with the COVID 19 pandemic by preventing homeowners mortgage.

STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. If the HPTAP application is submitted and approved by the Board of Review by May 1 2020 the exemption. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

A lawyer may be able to help a homeowner enter into a payment program. Consult With ECG Tax Pros. The Department of Revenues Property Tax Oversight p rogram provides oversight and assistance to local.

Rated Number One For Businesses. With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are having a hard. The STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

Florida Property Tax Consulting Property Tax Tax Payment Tax Consulting

What S My Property S Tax Identification Number

Secured Property Taxes Treasurer Tax Collector

What Is Florida County Tangible Personal Property Tax

Deducting Property Taxes H R Block

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Quit Claim Deeds Corporate Home Ownership And The Homestead Exemption Property Tax Adjustments Appeals P A In 2021 Home Ownership Homestead Property Property Tax

Secured Property Taxes Treasurer Tax Collector

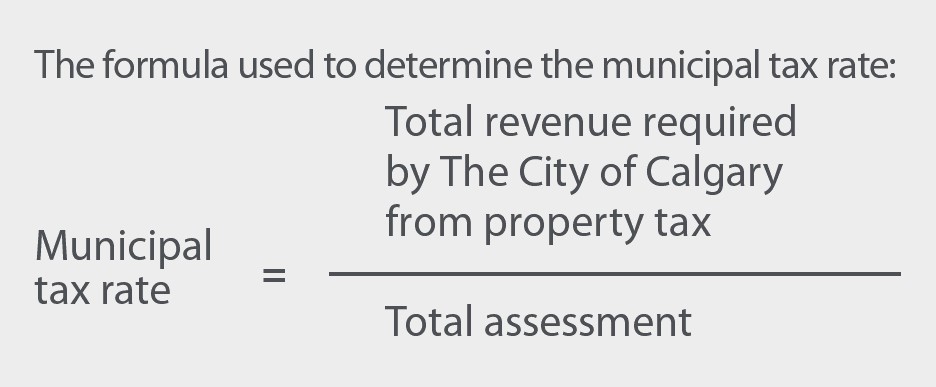

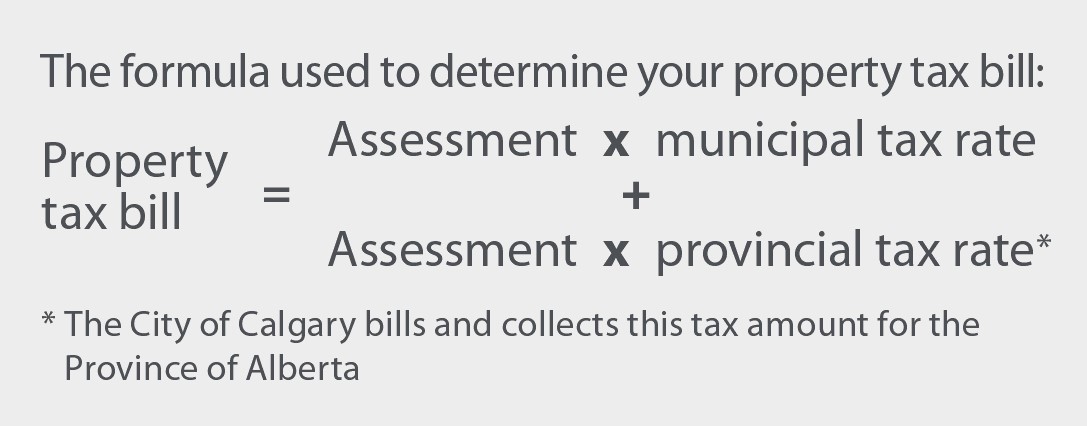

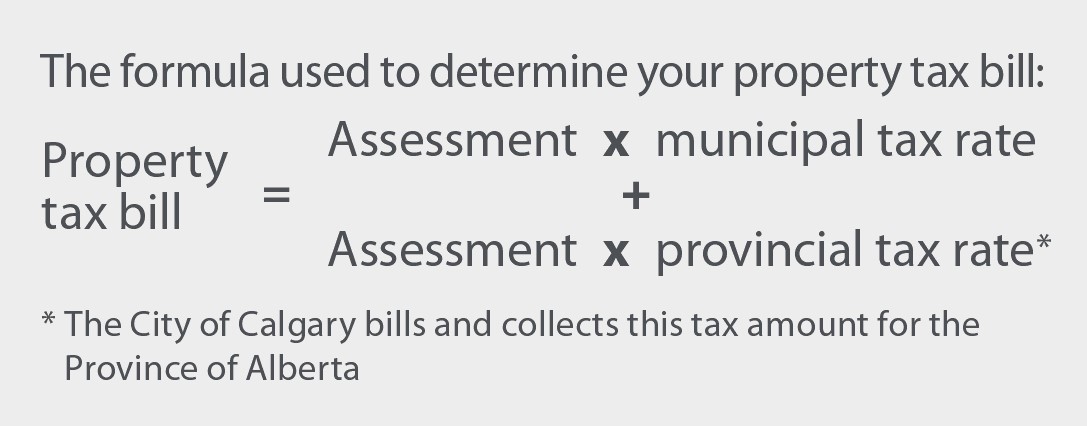

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida Property Tax H R Block

How To Save For Your First Home Buying Your First Home Paying Off Credit Cards Lead Generation Real Estate

Property Tax Collection Dips As Palike Fails To Fix Glitch Property Tax Fix It Glitch

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Tennessee Property Tax Relief Program Help4tn Blog Help4tn